Multi-country Payroll Software Built for Asia.

One Platform.

Zero Stress.

HR Forte automates payroll, tax, compliance, time attendance, leave, claims and year-end reporting across Asia — all in one platform.

Built for fast-growing companies and service providers who need accurate, compliant, and scalable payroll for multi-country teams.

What Makes HR Forte a Smart All-in-One Payroll System?

%20(2).png)

Country-Accurate Payroll Calculations

HR Forte calculates payroll using real-time statutory rules for each Asian country, ensuring accuracy and compliance automatically.

- Updated statutory rules for 7+ Asian markets

- Pre-built calculators for tax, contributions, overtime, prorations

- Monthly and year-end tax compliance included

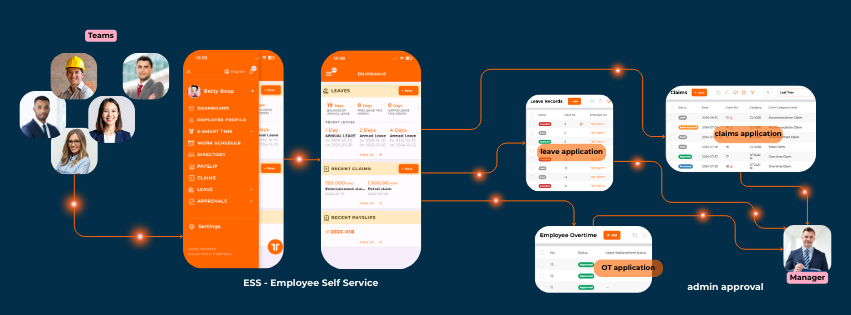

Full Workforce Suite in One Place

All HR and payroll data sits in one system, reducing manual work and eliminating errors from multiple tools.

- Time & Attendance (eSmartTime)

- Leave management

- Claims & reimbursements

- Payroll processing & reporting

- Employee self-service

Multi-Entity & Multi-Country Support

HR Forte supports multi-entity companies across Asia, letting HR run payroll for all locations on a single platform.

- Local rules for each entity

- Consolidated payroll reporting

- Group bundle pricing

AskGenie: AI Compliance Assistant

AskGenie gives instant HR and payroll answers so teams can work confidently without waiting for experts.

- Answers HR, payroll, tax, labour law questions in 19 APAC countries

- Helps users navigate the system (how-to + where-to)

- Reduces support tickets

.png)

Built for Service Providers & BPOs

Service providers can manage hundreds of clients using HR Forte’s unified dashboard and bulk payroll tools.

- Discounted pricing

- Multi-client dashboards

- Bulk processing

- White-label support

Why HR Forte?

Fast Setup

Most clients go live within days, not months.

Asia-Focused Compliance

AskGenie is trained. HR Forte knowledge hub is updated frequently from reliable sources and local experts.

Transparent Pricing

Free for up to 10 headcount, and as low as USD 1.50 / headcount for large teams.

Built for Accuracy

Clients trust us for clean audits, on-time payroll, and transparent reports.

Eco-Friendly & Digital

Built-in eSign reduces paperwork and speeds up approval cycles.

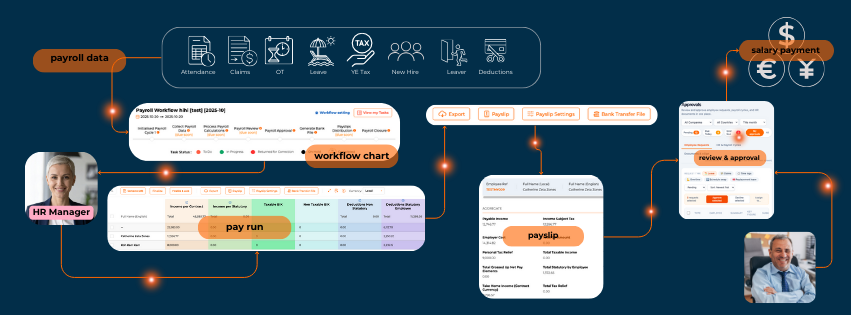

How HR Forte Runs Payroll End-to-End (Automatically & Accurately)

HR Forte follows a guided 8-step payroll workflow that ensures every cycle is accurate, compliant, and audit-ready across all Asian countries.

.png)

1. Initialise Payroll Cycle

HRF automatically generates a new payroll cycle for your entity, pulling forward previous settings, rules, and employee data.

2. Collect Payroll Data

All payroll-related information flows into the cycle - Time attendance - Overtime-Leave - Claims reimbursements - Adjustments.

3. Process Payroll Calculations

HR Forte applies real-time statutory rules for each country — including tax, contributions, allowances, and proration.

4. Payroll Review

HR and finance teams can review all salary components, variances, and exception alerts flagged by AskGenie.

5. Payroll Approval

Multi-level approval flows ensure the right stakeholders validate payroll before release.

6. Generate Bank File

HRF produces bank-ready payment files (GIRO/CSV formats depending on country) for quick and secure salary disbursements.

7. Payslips Distribution

Approved payroll automatically triggers payslip generation inside the Employee Self-Service (ESS) portal and mobile app.

8. Payroll Closure

Once completed, HRF locks the cycle for audit integrity and carries clean data forward to the next month.

Why Global Payroll Software Struggles in Asia

- Designed for US/EU rules, not Asia focused

- Limited statutory localisation

- Manual overrides for local compliance

- Poor year-end tax handling

- No built-in local knowledge

Try HR Forte with FREE Plan

Have questions?

What countries does HR Forte support?

Singapore, Malaysia, Vietnam, Thailand, Hong Kong, Philippines, Cambodia — with more Asian markets being added.

Does HR Forte handle year-end tax filing?

Yes. Each country’s year-end requirements are automated and included in the platform. You can use our Year-end tax finalisation module where annual processed finalised payroll data will be pulled and consolidated to calculate the annual tax reconciliation.

Is HR Forte suitable for service providers?

Yes. We designed special dashboards, bulk payroll tools, and discounted pricing for service firms.

How does AskGenie help HR teams?

AskGenie provides instant answers to HR and payroll compliance questions, reducing time spent on research.

How much does HR Forte cost?

Free for <10 headcount; USD 1.50–3.00 per headcount for larger teams. Group bundle discounts available.